Everybody’s got an opinion about what moves markets these days – well, almost everybody.

Yes, it’s “’tween” time, halfway through the marketing year, when big movers are harder to find.

And that only partly explains USDA’s reticence why the agency made no revisions to its 2024 U.S. crop numbers in its March 11 World Agricultural Supply and Demand Estimates. Seasonal factors took a back seat to the big elephant in the room: tariffs. Some tariffs are in place, others could eventually take their place, and no one knows where they’ll wind up or when. So not trying to predict the impact means not making wholesale changes to the outlook when markets are uncertain enough as is.

Better to measure twice and cut once.

Beware the Fed

History backs that carpenter’s rule, especially with the Federal Reserve checking its own toolbox ahead of the next update to monetary policy due March 19.

The central bank isn’t expected to make any changes to its target range for benchmark Federal Funds, leaving it between 4.25% and 4.5%. Higher rates tend to support the value of the U.S. dollar, which generally is bearish for commodities denominated in greenbacks.

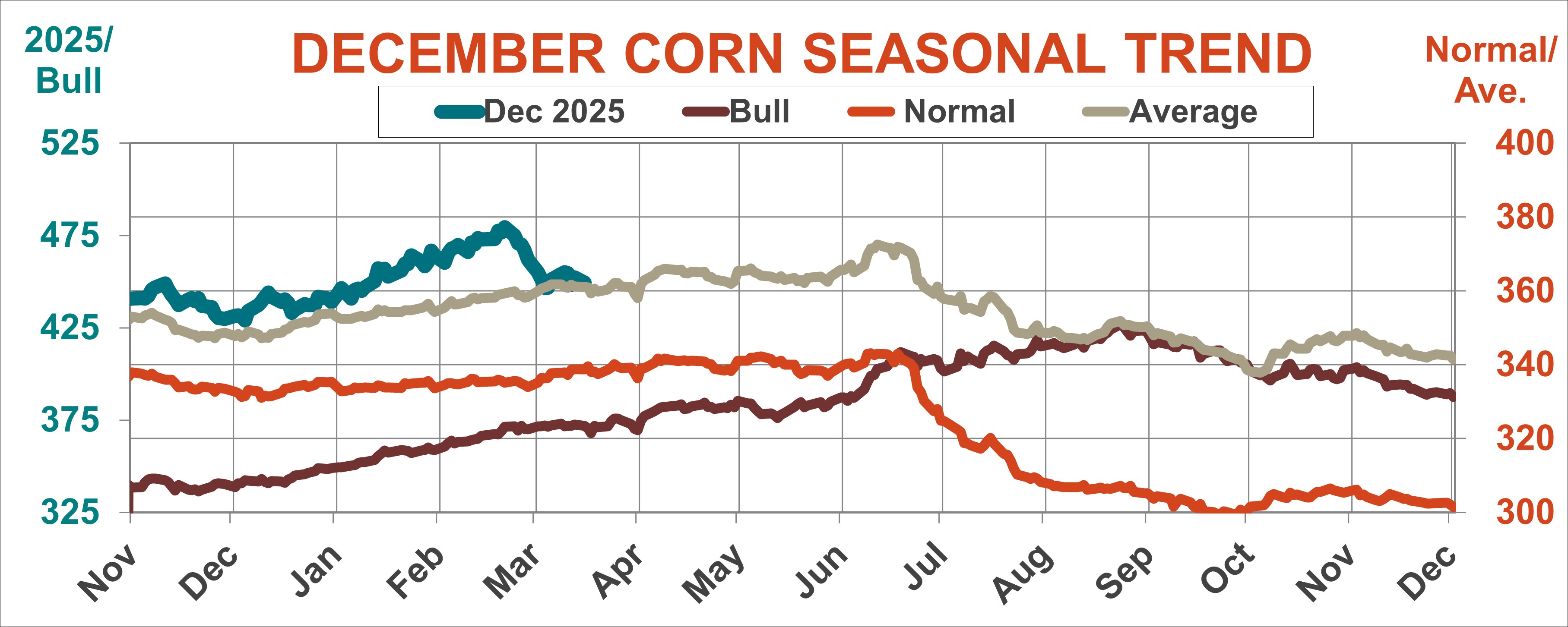

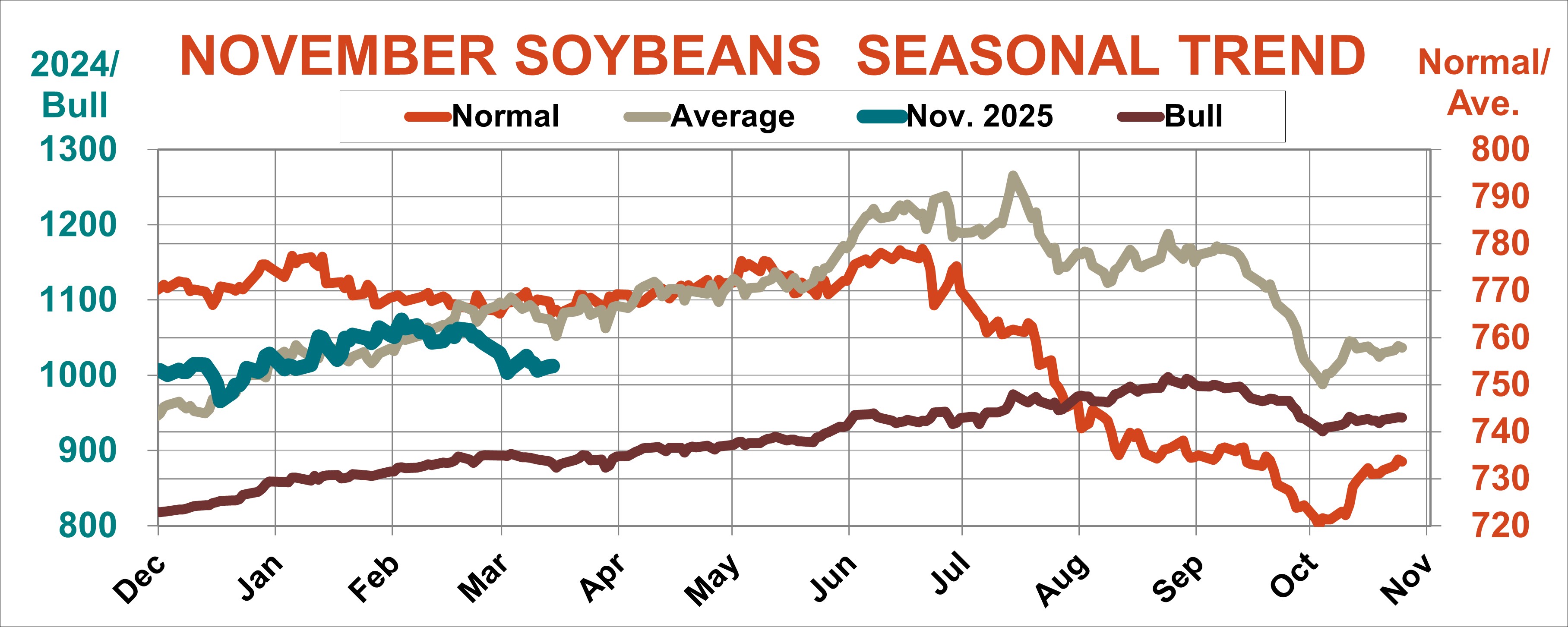

Barring a Fed surprise, new crop corn and soybean futures typically stage some type of rally from mid-March into spring.

For sure, we don’t know where those spring lows will come in. But if markets avoid a complete washout, current bottoms around $4.40 for corn and $9.95 for soybeans point to at least some pricing opportunities for those who need or want them. On average over the past 50-plus years, December corn mustered a 13.2% rally off spring lows, with the smallest bounce the 5.2% gain off the 2016 bottom.

November soybeans averaged a 14.5% bounce, with their nadir in the flood year of 1993 at 4.4%.

Bye-bye La Nina

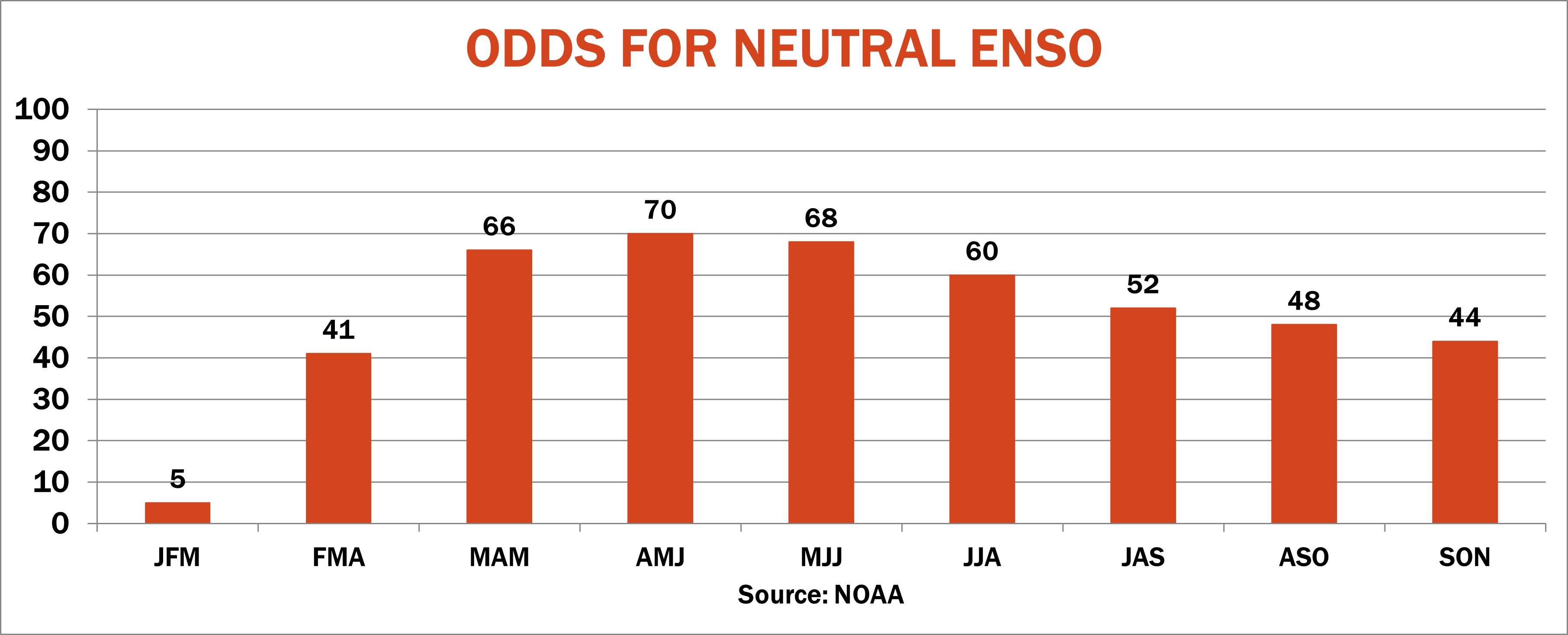

With facts like tariffs hard to discern, one “hard” number emerged that could provide fuel for a rally – or douse nascent embers: La Nina. U.S. weather forecasters – their own ranks under fire from budget cutters – said the well-known El Nino cycle would ease over the next month from La Nina cooling in the equatorial Pacific to its neutral phase, which would last until fall.

La Nina tends to be bad for U.S. corn and soybean yields, while its twin favors better crops. But weather is complicated, and no one single factor comes anywhere close to being an accurate Magic 8-Ball. Sometimes supply is the limiting factor for the market. At other times demand holds sway. Most years the two do a complicated dance, especially around the May Pole.

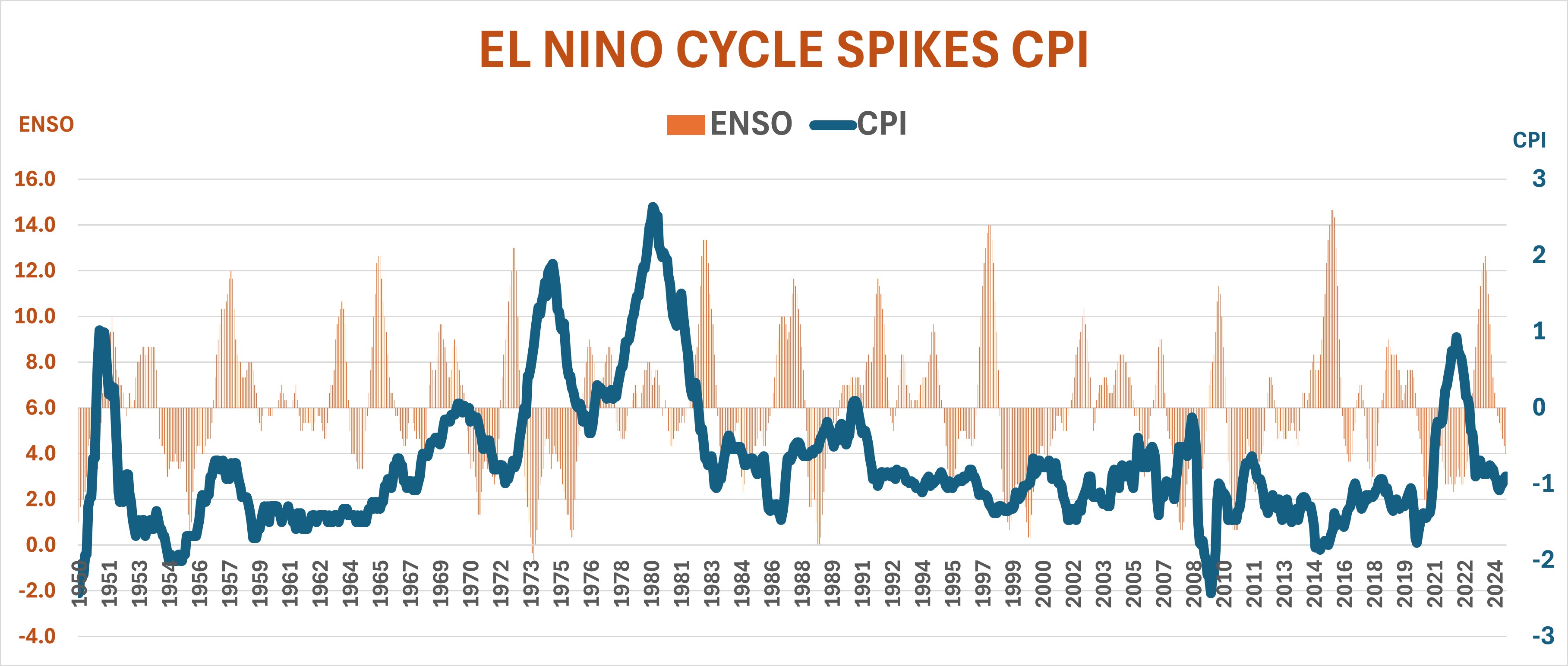

Indeed, a statistically significant correlation exists between the Consumer Price Index and ENSO. But? It’s not particularly strong, leaving plenty of room for other outcomes.

And opinions. That’s what it takes to make a market. One size doesn’t fit all.

So, the minimum rally projected for corn would take December 2025 to $4.63, little more than a dime off Friday’s $4.51 close, with the average rally around $5.05.

For November 2025 soybeans, the minimum target is $10.38, 20 cents above Friday’s $10.18 close. And the average rally? That projects to $11.39.