Volatility made the first quarter of 2025 far more challenging for producers than this time last year. It doesn’t matter which market – stocks, commodities, crypto, currencies – active markets shot everybody with a jolt of unexpected stress.

Headline risk is real and appears to be an ongoing consideration when managing whatever risk relates to your operation or your portfolio. Geo-politics is driving much of the unpredictability. Everyone knows it’s impossible to read the minds of world leaders and forecast how they will react to tariff shake-ups and the repercussions of new policy over the next six months.

Consider the topic of China and how they are re-setting or at least re-visiting existing arrangements regarding cattle trade:

- CHICAGO/BEIJING, March 14 (Reuters) – “Hundreds of U.S. meat plants granted access to China in a 2020 "Phase 1" trade deal with President Donald Trump are set to lose export eligibility on Sunday, threatening roughly $5 billion in trade to the world's largest meat market amid a renewed trade war. “Losing access to China would deal a fresh blow to American farmers after Beijing earlier this month placed retaliatory tariffs on some $21 billion worth of American agricultural goods, including 10% duties on U.S. pork, beef, and dairy imports.”

No signs currently suggest Beijing is imposing a blanket ban. Several hundred plants have had their registrations renewed until 2028 or 2029. So, while the headlines are worrisome, they are not as bad as they first may seem. Of course, circumstances will continue to change.

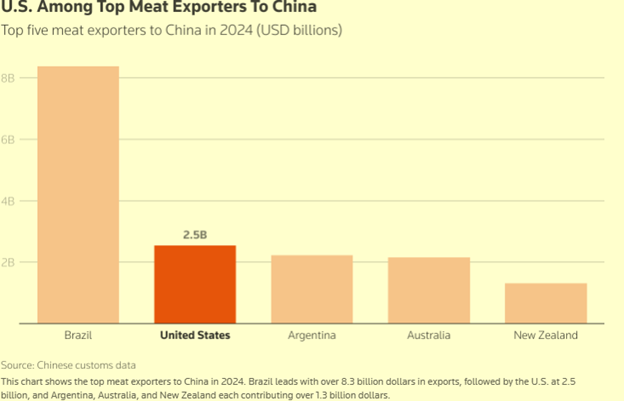

It’s just another example of the prevailing Chinese trepidation seeping into U.S. markets. The U.S. was China’s third largest meat supplier last year after Brazil and Argentina, accounting for 590,000 tons or 9% of total imports.

The bright spot for cattle and hog producers? We are at or near all-time highs. Still, just think about this story growing legs. It would be like having soybeans step into a buzzsaw at $16. As a producer, unless you spent the last 4½ years trapped in a bunker or in a medically induced coma, you are aware of the almost-uninterrupted bull market in cattle since the COVID lows.

Now look at the carnage in the canola market over the last three weeks.

Canola is the "victim" of the China/Canada battle over electric vehicle subsidies.

File this under the funds "got it wrong" and consider it akin to coyotes in a trap. The funds currently are "chewing off their leg" to get out of a bad long hook. Down 1.22 in three weeks.

Why are we talking cattle and canola?

Fear. Uncertainty. Cautionary thoughts. We don't want the same dynamics to roll from meat and canola to soybeans and corn. So, we do what we can do.

The most critical thing I say when working with clients? Defend your biggest basket of risk and do it first. You must be willing to sacrifice the cost of the defensive hedge in exchange for the ultimate goal, the real payoff: A good sale in the cash market, not in your hedging account.

What you don't want is to hold grain into new lows – and then sell. The trick is to be able to stomach new lows in the cash market and keep your hands in your pockets. You need the defensive put before the ugly sell-off is upon us.

Use old crop corn as an example: Six months to rally over $1 and 2 weeks to give back half of that move. Not a soul can tell you or me where we will be in September 2025.

Three wishes

What would be nice?

- A swift resolution to trade arguments (if only)

- Continued brisk demand

- Some sort of weather issue (a scare is better than an actual issue) that cuts production estimates and gooses producer prices

What to do before March 31?

The key here before USDA releases the Prospective Plantings and Grain Stocks reports on March 31 is: Don't be oversold with sales or short futures.

- Use a put to defend against bull betrayal. But keep your upside open. Spend a dime and hope for a 40-cent rally. That puts you 30 cents ahead of the game with your powder still dry. Then do it again on another 40-cent rally. Spending 20 cents on 80 cents of gain works all day long!

The takeaway from all this excitement and noise and, most importantly, movement? You can use it to your advantage.

Think of current market swings as a pendulum lumbering back and forth past its low center of gravity. We see daily gyrations and weekly settlements but often don’t see markets all that different when the dust settles on Friday’s prices.

Sure, we are trending in some markets, but corn and beans have been dancing between their respective 100- and 200-day technical levels for several weeks now.

End-of-month USDA reports loom, and most buyers and sellers are aware of that potential reset. So, when these markets trend higher one day and then stall and spike lower the next, you can be prepared at these short-term signposts and set hedges at these reaction levels. The educated guess is we will drift back to the low gravity points in the range.

Don’t get caught buying calls at the upper end and puts at the lower end. Be patient. Let the market come back to you to know that the real breakouts will likely be after USDA rearranges the stage at the end of the month.

For more insights and personalized advice, consider consulting with a professional risk advisor. Their expertise can guide you through these volatile times, ensuring that your marketing strategies are both effective and resilient. With the right plan in place, farmers can navigate the uncertainties of the market and make informed decisions that support their financial success.

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.