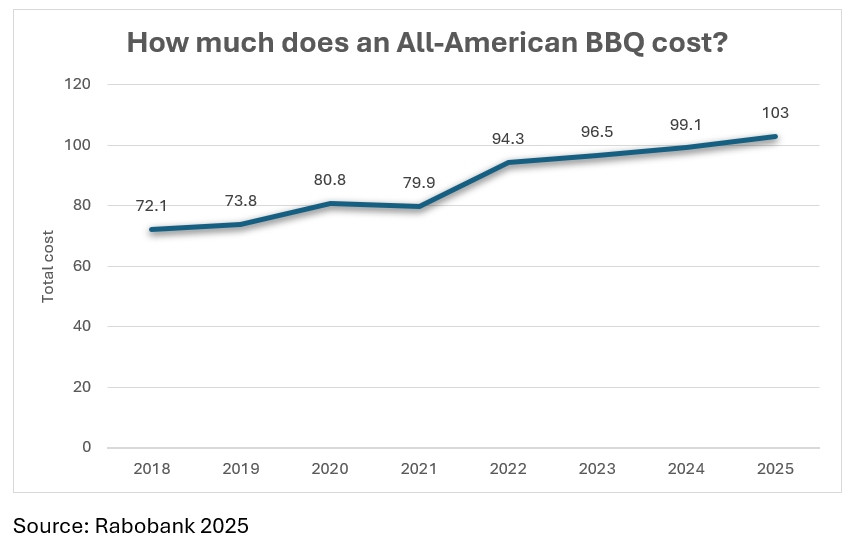

Consumers may simply see a 4% increase in the cost of a Memorial Day BBQ, but farmers who look at the agricultural economics behind those numbers can find hot opportunities and cold financial realities.

The cumulative result is the cost of an all-American BBQ is up from $73 in 2018 to $103 this year. And that’s without including a deviled egg on the plate.

A deep dive into the 2025 Rabobank BBQ Index shows tariffs are a minor player, but food production costs and geopolitics weigh heavily on what’s happening between the farm and the table.

In the overall, several components contribute to higher food costs and consumer spending, according to Tom Bailey, senior analyst-consumer foods at Rabobank. During the company’s annual state-of-the-BBQ report on Tuesday, Bailey noted these factors:

- Input costs. Structural pressures in the food industry elevate costs starting at the farm gate, Bailey said. “Inputs for farmers are up about 10% against the long run averages on a real basis,” Bailey said. “This is primarily due to some of the geopolitical challenges we're seeing amongst other things in that complex world of farm inputs.”

- Trade flows. “We're also still in the process of realigning global trade flows,” Bailey said.

- Regulatory costs. “We also see regulatory costs associated with changing ingredients around MAHA [Make America Healthy Again] is one example,” Bailey said. He cited companies that are reformulating to phase out food dyes as one example.

- Labor costs. “Labor costs also remain elevated, nearly 1% above long run averages, and uncertainty continues to play a role for many companies who are having to adjust their risk management strategies, which is often an additional cost,” Bailey said.

- Tariffs. “Tariffs do add … less than a quarter of a percentage on overall food,” Bailey said. The U.S. food industry is thankfully fairly insulated from a lot of the trade wars. Over 85% of our food is processed and produced here in the U.S. And when we look at the BBQ specifically, we're looking at just over 90% of our barbecue is comprised of U.S. ingredients.”

Beef prices on simmer

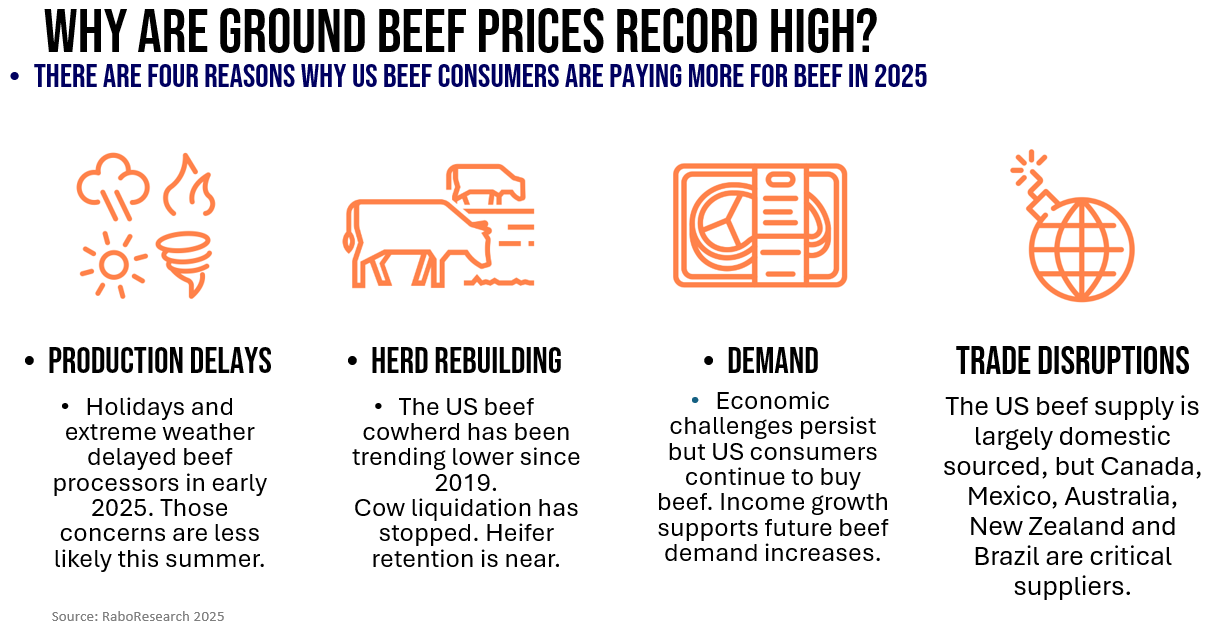

In one piece of encouraging news for consumers, an unusually sharp upswing in retail beef prices in early 2025 appears to be easing just in time for the grilling season, Senior Beef Analyst Lance Zimmerman said.

Retail beef prices posted 3% month-over-month jumps early this year, reflecting strong holiday demand and extreme winter weather that disrupted processing, he said. More recently, prices have settled down. It’s “incredibly rare” for retail beef prices to move 2% higher or lower on a monthly basis, Zimmerman said.

After some harsh storms and extreme cold in cattle country, the industry “got a lot of those kinks worked out as they worked through the winter and early spring months,” Zimmerman said. “And now we're less likely to see some of those production delays pop up as we navigate the next 60 to 90 days.”

We saw “explosive growth in February and March, and we're less likely to see it over the next several months as grilling demand really picks up,” Zimmerman said. “A lot of the retail price increases may actually be behind us, specific specifically when it comes to ground beef.”

That doesn’t mean beef is getting cheaper. Retail beef prices remain at or near all-time highs, a reflection of U.S. cattle inventories that at the beginning of the year shrank to a 74-year low. Live cattle futures hit a record high above $2.18 per pound last week and are currently above $2 into early 2026, indicating little near-term relief ahead for consumers.

During April, lean and extra lean ground beef averaged $7.55 per pound at U.S. grocery stores, up 11% from $6.81 in the same month in 2024, according to USDA data. Ground beef averaged just under $7 last summer.

But whatever the price, Americans still love their beef, Zimmerman said. He expects strong U.S. beef demand again this year. While prices are going up and consumers are increasingly stressed, “buying retail beef is still a relatively cheap lifestyle upgrade that consumers can make.”

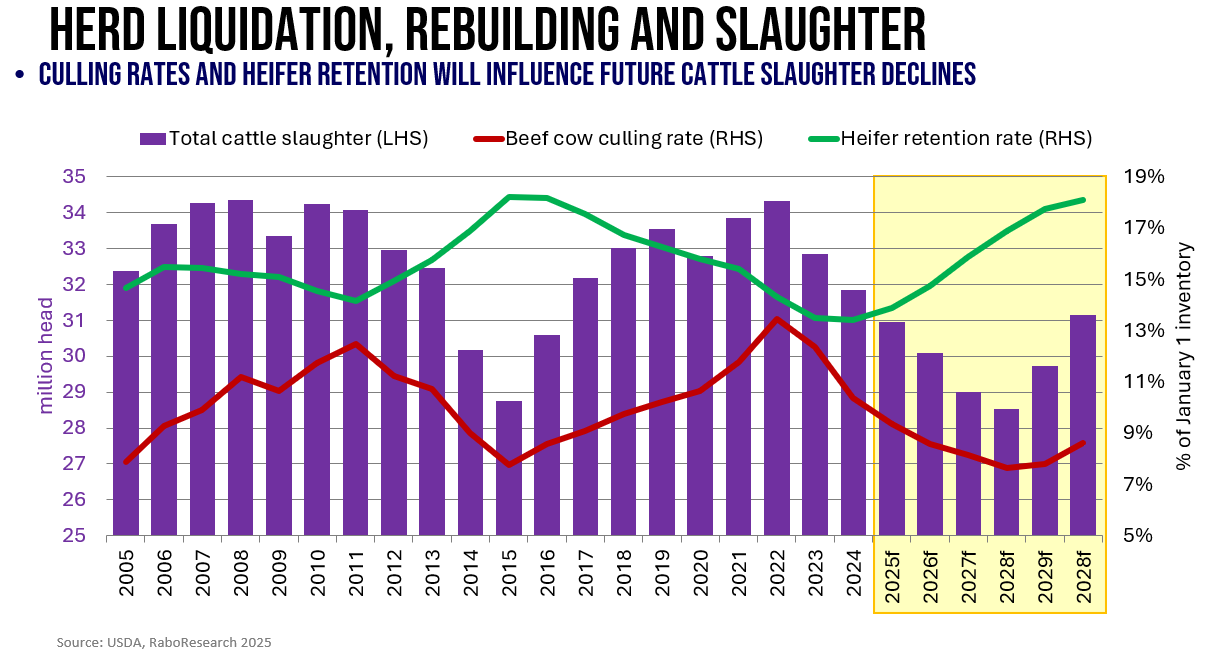

Zimmerman noted signs the U.S. cattle herd is in the early stages of expansion after protracted Plains drought and high feed costs led to several years of herd liquidation. Retention of young females, or heifers, for breeding appeared to bottom last year and is expected to climb through at least 2028, based on a Rabobank forecast.

“As we transition through the rest of the decade and into the early 2030s, beef production and domestic cattle slaughter are going to increase as the herd rebuilds,” Zimmerman said.

Cheese demand increases

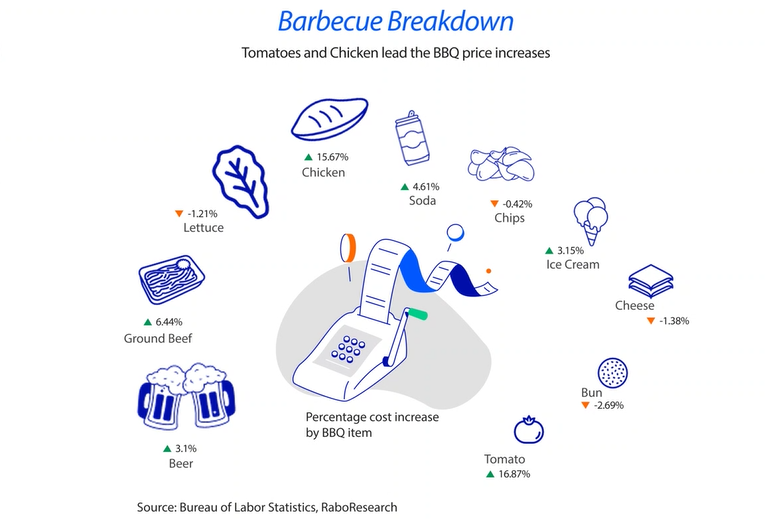

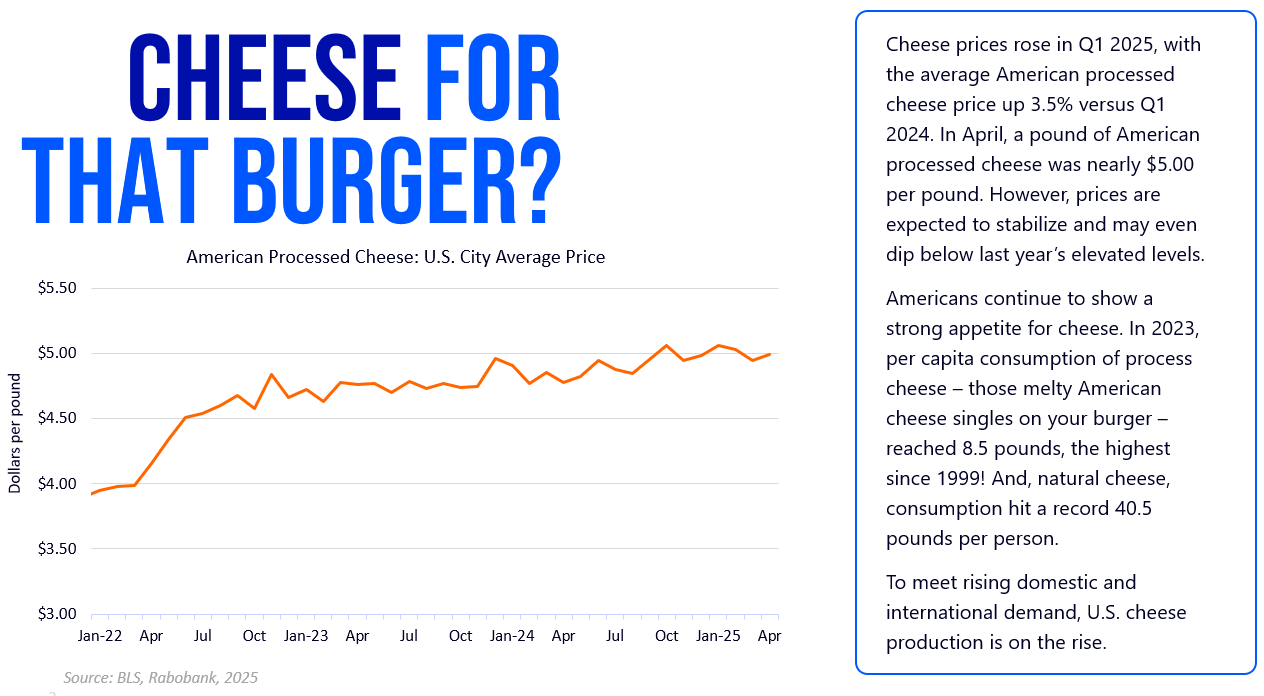

Consumer prices for key dairy products have been uneven this past year, according to Mary Ledman, global dairy strategist with Rabobank. Specifically for the company’s 2025 BBQ Index, ice cream prices trended 3.15% higher year-over-year, while cheese prices shifted 1.38% lower compared to 2024.

Ice cream prices are mostly affected by the prices of its components – sugar, cream and so forth. Consumption is the lowest on record since USDA began collecting data in the 1970s, which Ledman attributes to competition among other nondairy frozen treats.

Other dairy is another story, Ledman adds.

“Americans continue to show a large appetite for cheese,” she notes, pointing out that per-capita consumption of processed cheese rose to the highest level since 1999, with the average American eating 8.5 lbs.

And while cheese exports rose 7% in the first quarter of 2025, the vast majority of cheese produced domestically is also consumed in the U.S.

“Chicken tender war” breaks out

High beef prices have contributed to the trend toward costlier poultry, with chicken, particularly breast meat, showing “explosive” growth in recent years, according to Rabobank’s Christine McCracken, senior analyst-animal protein. Wholesale breast meat prices in early 2025 soared 56% over year-earlier levels.

Part of that growth has been driven by restaurants and other food service businesses, which are increasingly focusing on and promoting lower-cost protein sources like chicken, McCracken said, citing McDonald’s Corp.’s recent launch of McCrispy Strips as an example.

There appears to be a “new chicken war” breaking out amid expanding tender options on restaurant menus, McCracken said.

McCracken said chicken breast prices appear to be leveling but expects them to remain relatively high, despite the typical seasonal shift to other proteins during summer grilling. She also pointed to a demand shift as consumers turned to dark meat items, like bone-in thighs or leg meat, especially during the grilling season.

One reason chicken prices may remain elevated is that there is a relatively limited production growth outlook for the poultry industry, despite historically high margins. Historically, when margins were at current levels, the poultry industry typically responded with a 2% to 3% increase, McCracken said. That’s not happening this time, in part due to disease challenges not entirely connected to avian influenza.

“While it's easy to assume that this might be tied to aviating influenza, in fact, it's not,” McCracken said. “There are a few other health challenges in the poultry industry that are forcing a higher mortality level and limiting production growth.

“We're not expecting to see a big production response here over the rest of the year, which is supportive of chicken prices,” McCracken said. “Breast meat prices are expected to stay high, but it's really been the strength and the dark meat prices that's come as a big shock.”

Boneless chicken breast averaged $4.18 per pound at U.S. supermarkets in April, up 3% from the same month in 2024, according to USDA.

Highest price risk? Produce

Produce prices are often the most volatile components of the BBQ Index because they are particularly susceptible to “weather shock impacts,” according to David Magaña, senior analyst for fresh produce at Rabobank.

“It’s a mixed bag this year,” he says.

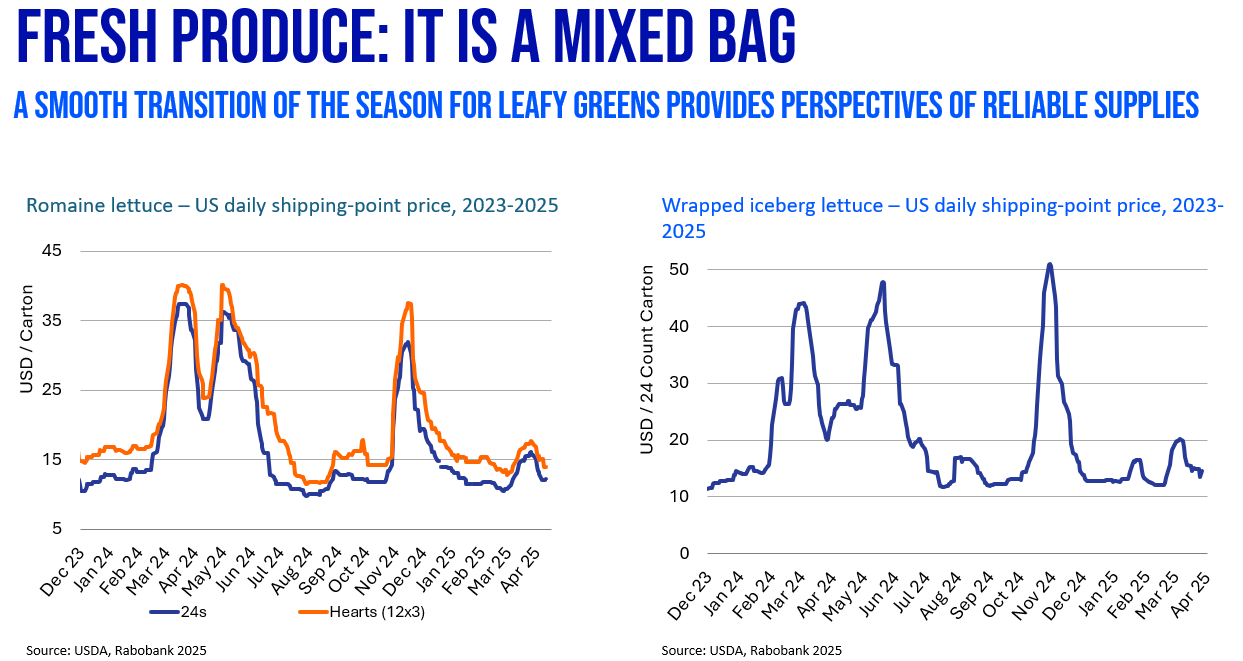

That’s because lettuce prices have seen a smooth transition from production in Northern California to the southwest desert this spring, which has kept prices mostly level. The BBQ Index even noted a modest price decline of 1.2% from 2024.

That’s not the case with tomatoes, however, with prices jumping 16.87% higher year-over-year.

In part, the cause is a heavier reliance on imports. Around 95% of lettuce consumed in the U.S. is produced here. But around 7 in 10 tomatoes are imported, with 90% of that incoming volume originating in Mexico.

What’s more, tomatoes could become even more expensive moving forward, Magaña says. Starting on July 14, fresh tomatoes from Mexico will come with an additional 21% duty following recent actions by the U.S. Commerce Department.

Avocado sales spike during the Super Bowl and Cinco de Mayo but are increasingly popular year-round, Magaña says.

“Despite a rapid increase in consumption, we believe there is still room to grow,” he says, pointing out the fact that Americans eat around 9 pounds of avocados per year, while Mexico’s per capita consumption is around 20 pounds per year.

The Rabobank BBQ Index assumes an average American BBQ of 10 adults with each consuming one cheeseburger with lettuce and tomato, one chicken sandwich with lettuce, tomato and a slice of cheese, two handfuls of chips, two beers, a soda and a few scoops of ice cream. As a means of comparison, the BBQ Index parallels the Bureau of Labor Statistics as a data source, specifically the monthly data series Average Price Index, U.S. City Average.