Corn futures resumed a downward trend while soybean futures posted modest gains after USDA’s Acreage and quarterly Grain Stocks reports today delivered few surprises, returning market focus to largely crop-friendly weather that’s fueling expectations for strong yields and big harvests.

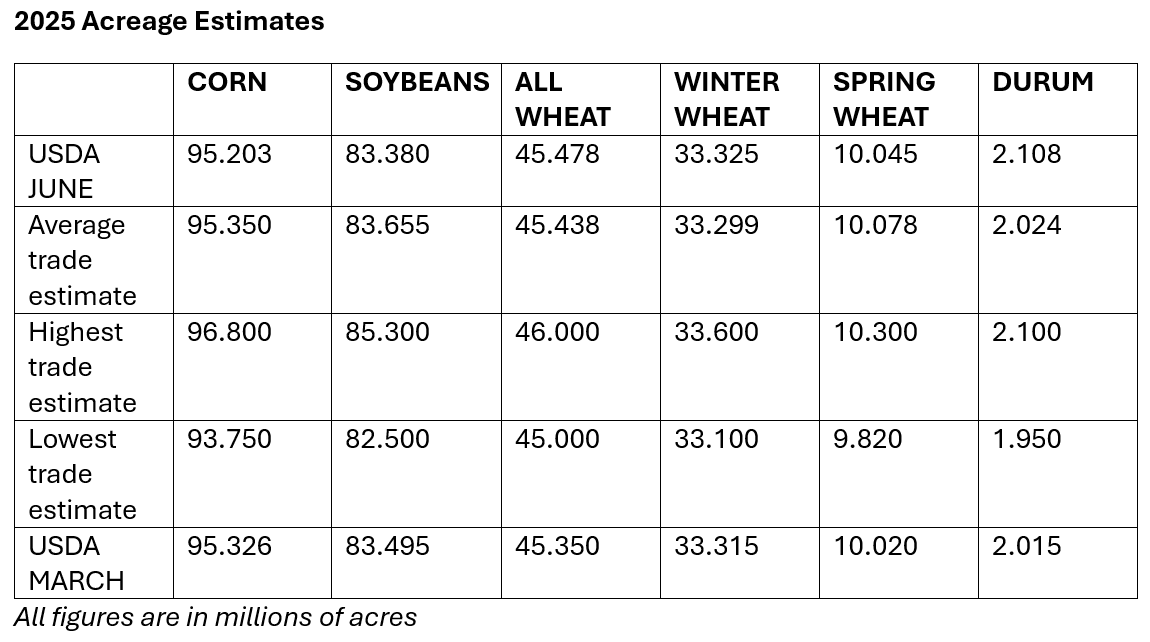

USDA’s Acreage updates for corn and soybeans came out slightly below analysts’ expectations but market reaction was relatively muted.

December corn fell 1.5 cents to $4.2575 per bushel, the new-crop contract’s sixth decline in the past seven days. November soybeans rose 2.25 cents to $10.27 after trading on both sides of unchanged. Soybeans quickly rebounded from an initial dip that was likely a reaction to a higher-than-expected number in USDA’s quarterly Grain Stocks report.

USDA cut its 2025 U.S. corn plantings estimate to 95.203 million acres from 95.326 million acres forecast in its March Prospective Plantings report. The figure was slightly under the average analyst projection at 93.35 million acres. Estimates ranged from 93.75 million acres to 96.8 million acres.

Soybean plantings were adjusted to 88.38 million acres, down from 83.495 million acres in March and below the average analyst estimate of about 83.655 million acres. USDA’s updated soybean acreage would be down 4.2% from 87.05 million acres seeded in 2024.

Acreage numbers not widely out of line

With USDA’s corn and soybean acreage figures not widely out of line compared to trade expectations, grain markets quickly turned attention back to the Midwest weather outlook for July, which so far appears unthreatening to crops.

Arlan Suderman, chief commodities Economist at StoneX, said U.S. soybean acreage may be eventually revised even lower later this summer, “based on our expectations that the late wheat harvest will prevent some double-cropped soybeans to get planted.”

The late wheat harvest “likely would not have fully been accounted for in this June 1 survey,” Suderman said. He added that “none of these acreage numbers are really market movers, other than the fact that an even-lower soybean acreage estimate leaves us more vulnerable to a weather scare.”

“But overall,” Suderman added, “This is one of the tamer June 30 sets of reports that I've seen in a while, with the market now moving on to trade weather, potential trade agreements and biofuel policy.”

USDA’s acreage estimates were based on mail, phone and internet surveys of about 67,000 farm operators during the first two weeks of June, the agency said.

The updated corn acreage would still be the biggest since 2013 and the third-most for any year since 1944. Historically high acreage combined with an ahead-of-average planting pace and largely favorable Midwest weather this spring has bolstered beliefs farmers may reap a bountiful harvest near or above USDA’s 15.82-billion-bushel forecast.

Excess rainfall much of last spring that delayed fieldwork in the eastern Corn Belt raised questions whether farmers would attain USDA’s high corn acreage figure. In today’s report, USDA estimated about 3.63 million acres of corn was left to be planted, along with 11.55 million acres of unplanted soybeans. It’s unclear how much, if any, of that unplanted ground had been planted since mid-June.

Soybean supplies up sharply, higher than expected

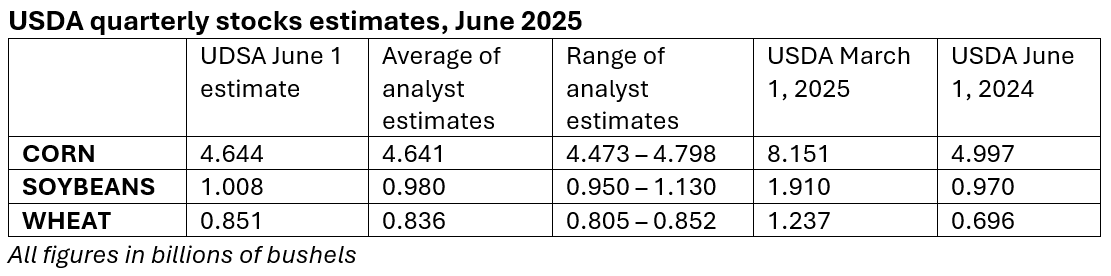

In its quarterly Grain Stocks report, USDA pegged June 1 corn supplies at 4.644 billion bushels, about 3 million bushels above expectations and down 7.1% from the same date in 2024. June 1 soybean stocks totaled 1.008 billion bushels, above expectations for a number closer to 980 million bushels and up 3.9% from the same date a year earlier.

Nationwide wheat stockpiles totaled an estimated 851 million bushels as of June 1, about 13 million bushels above expectations and up 22% from the same date in 2024.

Suderman said the corn, soybean and wheat stocks estimates “suggest less residual usage, which translates into less feed usage for wheat for the previous marketing year, with implications then for the current year as well.”

“That's been a pattern for USDA in recent years,” Suderman continued, “suggesting that perhaps it is underestimating the size of U.S. wheat crops.”