Congress recently passed the One Big Beautiful Bill, a sweeping package allocating $66 billion of additional funds to agriculture. From commodity payments to bonus depreciation to estate tax relief, this bill has major implications for farmers, landowners and ag businesses.

The BBB also includes an overhaul of payment limitation and attribution rules under USDA farm programs like ARC and PLC. These rules dictate who can receive commodity program payments and how much they can receive. For years, the operating structure of your farm had significant influence on how these limits were applied. Here’s what you need to know.

New payment limit

The individual payment cap has increased from $125,000 to $155,000 per person, and this limit is now indexed for inflation, meaning it will rise over time to keep pace with economic conditions.

This payment limit applies to most USDA commodity programs, including:

- Price Loss Coverage (PLC)

- Agricultural Risk Coverage (ARC)

- Marketing Loan Gains (MLGs)

- Loan Deficiency Payments (LDPs)

Attribution rules: Big shift for LLCs, partnerships and S-Corps

The biggest change is how the USDA attributes payments through entities. Historically:

- Only general partnerships were “transparent” for USDA purposes—meaning each partner could receive a separate payment limit based on ownership and active involvement.

- LLCs and S-Corps were treated as single entities, often limiting farms to one payment cap even if multiple members contributed materially.

Under the new rules, all pass-through entities (including LLCs, S-Corps, and partnerships) are now treated the same. Each member, shareholder or partner may now receive a payment in proportion to their ownership share and material participation regardless of the entity type.

What this means for farmers

This change is especially significant for farms that:

- Operate through LLCs or S-Corps for legal protection or succession planning

- Have multiple owners actively engaged in the farm

- Previously avoided LLCs due to USDA payment limitations

With equal attribution rules across entity types, farmers no longer need to rely on general partnerships maximize program eligibility.

Should you restructure your entity?

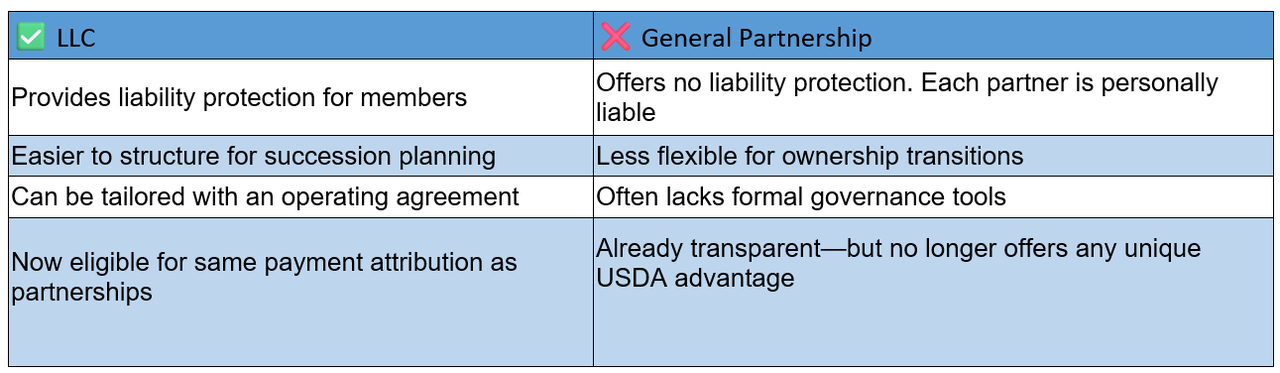

Now that entity type no longer restricts payment attribution, many farms may want to revisit their business structure—especially those still operating as general partnerships.

If your main reason for choosing a general partnership was to ensure transparent USDA payment limits, that advantage no longer exists. An LLC may now be the better fit for providing more protection and flexibility without losing USDA payment eligibility.

Practical considerations

- Mandatory material participation. Each owner must be actively engaged in the operation to qualify for their share of the payment limit.

- Required USDA documentation. Expect more scrutiny in verifying ownership structure and participation, regardless of entity type.

- Entity planning = Succession planning. With payment attribution no longer driving entity choice, you can now focus on choosing a structure that also supports long-term ownership, transition planning, and estate tax efficiency.

Final thoughts

This shift may seem technical, but it’s a meaningful change that simplifies decision-making for farm families. By eliminating a USDA bias toward general partnerships, the new attribution rules free farmers to choose the structure that best fits their goals.

Downey has been consulting with farmers, landowners and their advisors for nearly 25 years. He is a farm business coach and the succession planning lead at UnCommon Farms. Reach Mike at mdowney@uncommonfarms.com.