When is bad news for grain markets good news for growers? Bombshells big enough to rock Wall Street can ripple all the way to the Midwest, swelling into buying opportunities for farmers looking to hedge input needs for the coming year.

Stock prices cratered in seconds on Oct. 10, and all it took was one of Trump’s characteristically vague social media posts about new tariffs on China. With some markets, especially those on the East Coast, ready for a long weekend, traders voted with their feet to sell and worry about the consequences after a break for what used to be called Columbus Day before the Italian explorer got cancelled.

Markets far and wide followed Wall Street’s lead and broke hard. Some, like soybeans, have an obvious interest in China news. Others tanked because risk became a four-letter word for investors trying to preserve capital and live to fight another day.

That sentiment pummeled the dollar’s status as a safe haven, in turn driving buying in some commodity alternatives denominated in greenbacks, including gold, which surged to an all-time high. Grain markets didn’t share the love, which limited selling opportunities for farmers needing to hedge inventories.

But battered markets do have an upside – if they reduce fuel and fertilizer prices enough to benefit input buyers.

China slows fertilizer sales

Renewed worries about tariffs and trade between the world’s two largest economies come at a time when soybeans aren’t the only pain U.S. growers feel from the disputes. China also put the brakes on fertilizer exports.

The Communist Party usually limits exports seasonally to make sure growers there can get the nutrients they need. But slowing sales this time appear to be retaliation for U.S. trade measures – a not-so-subtle reminder that two can play the tariff game. As a result, Chinese urea shipments are down 6.5% year-on-year, while DAP sales are 10.2% lower, according to data from the General Administration of Customs of the PRC.

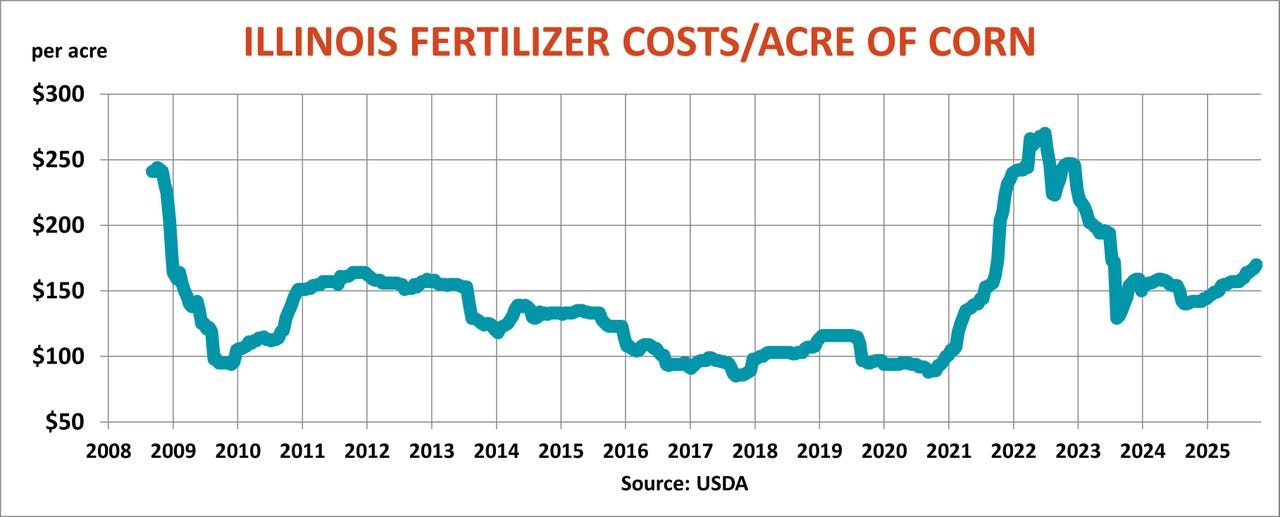

Regardless of whether those boats would have unloaded in the U.S., the decision to keep supplies in China spilled over onto the world fertilizer market. DAP at the U.S. Gulf cost 37% more than a year ago, while urea was up 15%. With potash supplies out of the post- Soviet states also restricted under Western sanctions, the cost of feeding an acre of corn is up 20% in Illinois.

Where are the bargains? Or are they here? Could current prices, though expensive, look like better deals later – if prices continue to rise through the winter and spring?

Is nitrogen cheap?

Ammonia was one nitrogen product that lagged behind the rest in this rally, at least for cargoes at the Gulf, which were up “only” 5.3% year-on-year. Don’t be shocked if your dealers are higher, depending on where their supplies originate. Illinois anhydrous was quoted 19% higher, thanks in part to problems with low water that raised barge rates on the Mississippi River due to shorter tows and reduced drafts.

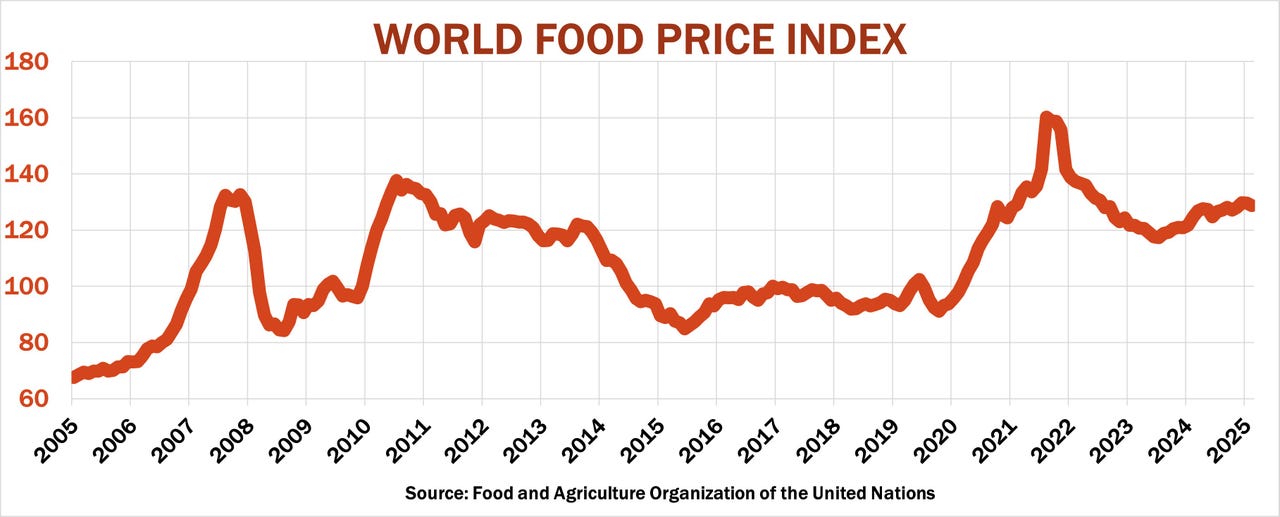

Demand also has a role to play as farmers figure budgets for spring – and, statistically, is more closely correlated with prices than supply. But the most important barometer to watch is food: Higher food prices act as a magnet for fertilizer costs, in part because rising revenues generally allow farmers to spend more on nutrients.

One yardstick I watch is the World Food Price Index published by the U.N. Food And Agriculture Organization, which explains 75% or more of the variance in different fertilizer compounds. The food component of the U.S. Consumer Price Index shows the same types of connections, though not quite as strong as the global metric, another sign of the importance of global supply and demand.

And even though the U.S. government remains mostly closed, the Bureau of Labor Statistics is expected to update inflation data Oct. 24, just in time for the next statement on monetary policy due from the Federal Reserve Oct. 29. Betting on Federal Funds Futures suggests a cut of ¼ of 1% is a done deal, taking the short-term benchmarks down to a range of 3.75%-4%, with one and possibly two cuts likely early in 2026.

Surprises from the Fed could trigger unexpected price movements in other markets. So, sharpen those pencils and get ready to hit the “buy” button if the time is right for your business.