The federal government shutdown kept grain markets mostly quiet in October, removing a vital source of supply and demand news. That relative silence is expected to lift dramatically in November, as President Trump plans negotiations with China, Russia and other players.

Uncertainty about the meetings spurred traders to pivot toward ag markets they normally ignore. And when Wall Street – as well as Washington – starts talking agriculture, farmers should pay attention.

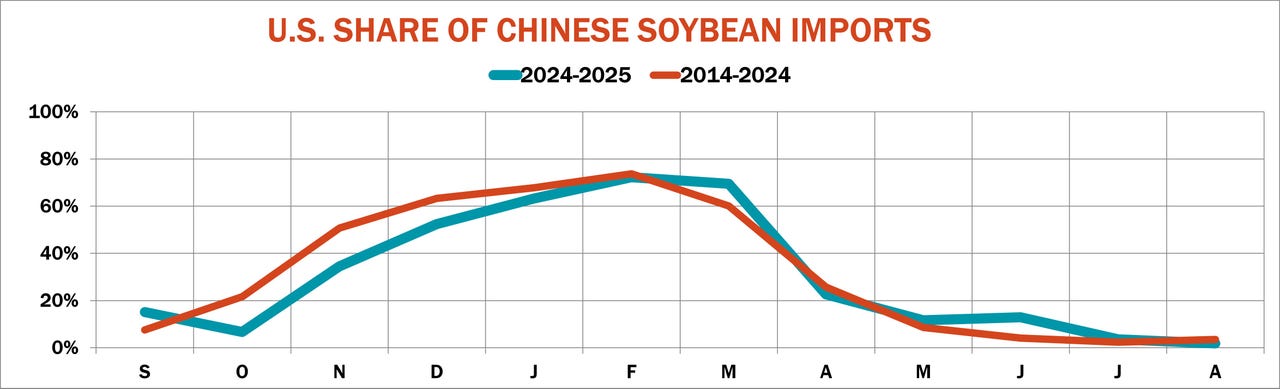

Soybeans are expected to play a significant role in any deal with China, same as the oilseed did after the showdown over trade toward the end of the President’s first term. The COVID pandemic derailed those goals, and skepticism remains about any “hard” numbers the two sides might settle on this time around.

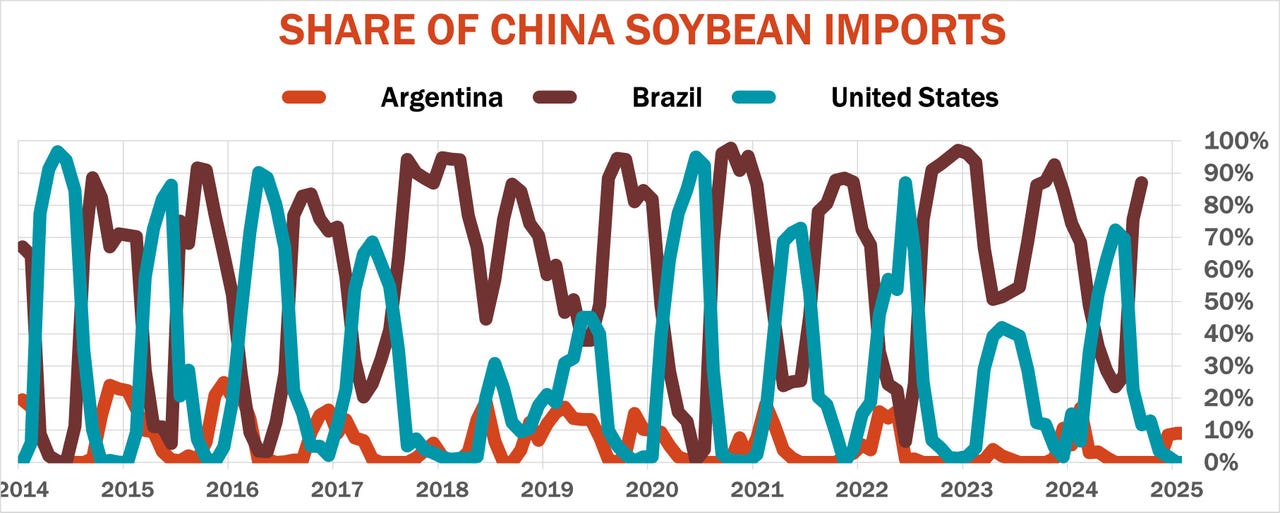

While some traders emphasized China’s absence from the list of U.S. soybean buyers in September, business is normally light as the U.S. harvest begins to fill the export pipeline. Ideas that Argentina could replace the U.S. as a supplier were always fanciful. Even if the South American country grew enough – it produces less than half the crop grown here – Argentina needs to keep most of those beans at home for domestic processing, a significant source of jobs, revenue and foreign exchange.

Talk of Argentine beef imports to ease U.S. food inflation also could be moot. The U.S. apparently bought Argentine pesos last week to prop up the beleaguered currency, but any more formal swap could hinge on a strong showing from President Javier Milei in weekend parliamentary elections. Any whiff of weakness could smell bad to financiers who remember Argentina’s previous defaults.

Interest rate conjecture spurs ag markets

All it took to roil the soybean market last week was Trump’s social media post about cooking oil. That plus a few wheels still spinning in Washington, enough to publish a delayed Consumer Price Index that may give the Federal Reserve a green light to begin a cycle of credit easing when the central bank updates monetary policy at the end of its two-day meeting Oct. 28-29. A cut of ¼ of 1% in the target range for Federal Funds, now fixed at 4% to 4.25%, is considered a sure thing.

Traders will parse the policy statement and comments by Fed Chair Jerome Powell – along with his possible replacements – for clues about how aggressive cuts into 2026 could be.

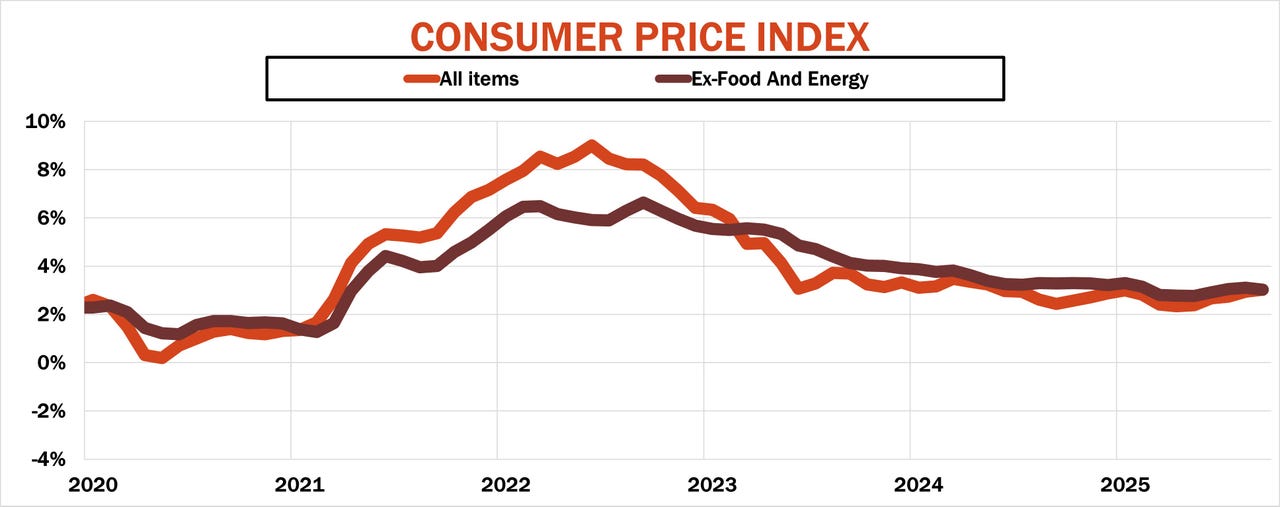

The CPI print mostly kept a lid on short-term inflation. The rate of increases slowed month-to-month, with prices up 3% year-on-year and just 1.5% when volatile food and energy components are stripped out. The Fed’s long-term inflation goal is 2.5% officially, though debate continues to rage over this “neutral” rate – the policy that keeps prices stable without either stimulating or restraining growth.

Energy costs are a big part of inflation, so uncertainty over imports of Russian crude by India and China due to sanctions triggered by the invasion of Ukraine extended the volatility to commodities. The poster child for that froth was an historic crash in gold that had investors wondering if a record stock market could be the next bubble – and one that’s ready to pop.

Other importing countries used China’s step back from U.S. originations to secure cargoes of their own. Whether that was new demand or just opportunism could depend on Brazil’s success raising another huge crop. Concern about early dryness as planting began in mid-September gave way to optimism for record production last week, perhaps another reason for China to pump the brakes on imports from the U.S.

Politics and economics each played a role in what’s turning out to be a complicated attempt to balance world markets.