China has agreed to buy 12 million metric tons of soybeans this year, Treasury Secretary Scott Bessent said, providing some relief to US farmers who have anxiously awaited the resumption of exports to the Asian nation.

For the next three years, China has agreed to buy a minimum of 25 million tons annually, Bessent said Thursday on Fox Business. Soybean futures erased earlier losses of as much as 2.2% after his comments, and were up 0.2% at $10.965 a bushel as of 8:41 a.m. in Chicago.

President Donald Trump said earlier that China will purchase “tremendous” amounts of American soybeans, following a meeting to hammer out a wide-ranging trade deal with his counterpart Xi Jinping. Trump said China will start buying immediately, but didn’t provide any additional details.

Missouri farmer Marty Richardson said the details about how much China would purchase eased the earlier sense of discouragement. “It’s not a big number, but it’s a number,” he said.

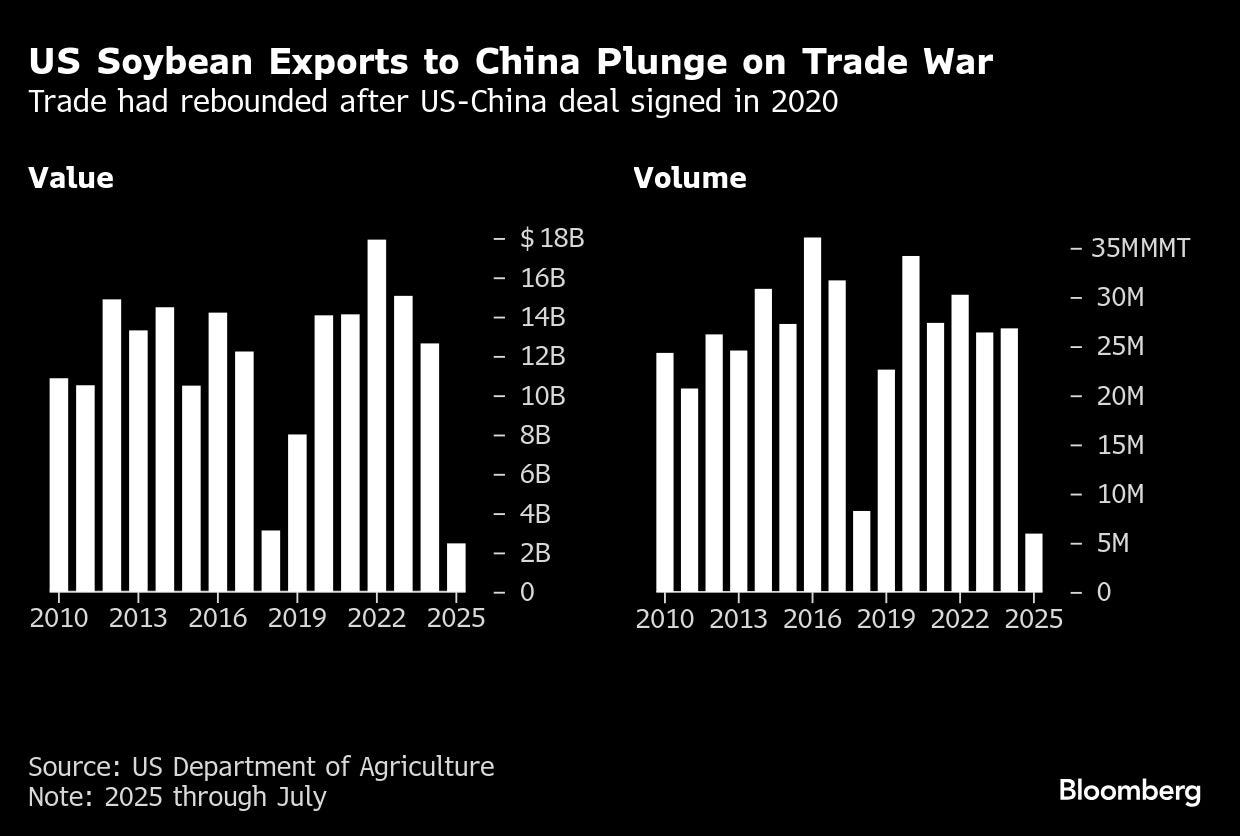

The agreement paves the way for the reopening of a trade that was worth more than $12 billion last year and is crucial for US farmers who have faced prolonged financial strain. Beijing had shunned US beans so far this export season, using the commodity as a bargaining chip in its trade war with Washington.

A commitment of 12 million tons for this year would be in line with many analysts’ forecasts. China has little need for additional soybeans currently as it has built up ample supplies with record shipments from South America. The amount is a “fairly sizable reduction from a historical standpoint,” said Brian Grete, a senior grain and livestock analyst at Commstock.

In the longer term, purchases of 25 million tons a year would be “basically getting back to normal,” Grete added. He said the details give soybean farmers and the markets “a little more security in terms of what should be known about the demand side of things from China.”

Last year, the US exported about 27 million tons to China, according to US Department of Agriculture data. Still, the commitment would be lower than the outcome of the trade war during Trump’s first term. After the so-called Phase One agreement in 2020, shipments to China rebounded to 34.2 million.

The industry is also still seeking clarity as to whether Chinese tariffs on US soy remain in place. Those tariffs would “almost have to be zero” for commercial Chinese players to profitably crush US soy, unless the government provided them with some aid, said Angie Setzer, co-founder of Consus Ag Consulting.

China in March announced extra tariffs on a slew of US agricultural products, including soybeans. When asked at a press briefing if China would cut duties on US agriculture products, He Yongqian, spokesperson for China’s commerce ministry, did not directly address the question.

The agreement may offer some comfort for US farmers, a key voting bloc for Trump and the Republican Party, who have been grappling with overflowing silos, while profits have been squeezed by higher input costs and falling prices. Soybeans are the US’s biggest agricultural export and China is the top destination.

Nebraska farmer Andrew Philips said he was heartened by a recent rally in soybean prices on optimism over a trade deal. “Still a ways away from some profitability numbers but it’s a lot better than where it was,” he said.

He was cautiously optimistic about the deal with China, saying “hopefully they follow through and maybe there’ll be more to come.”

Farmers and analysts will be watching how quickly shipments will start to flow. Bloomberg reported Wednesday that the country has bought at least two cargoes of US soybeans, its first known purchase this season.

The fact that Trump still has time in office puts him in position to ensure China remains accountable, said Randy Place, senior grain analyst at the Hightower Report. “Still having a few years left, he can hold them to that this year and next year and maybe the year after.”

But the extent of China’s appetite for US soybeans may be tempered as the world’s second-largest economy struggles to regain growth momentum, limiting demand for animal feed and food. Moreover, Beijing’s long-term strategy to diversify suppliers and reduce reliance on the US is expected to remain in place.

© 2025 Bloomberg L.P.