Traders won’t be eating leftovers for Thanksgiving, at least we hope not! But those at their desks in the week before the holiday dined mostly on cold plates of moldy data, as market reports delayed by the government shutdown dribbled out like tiny tapas dishes from the kitchens of overwhelmed cooks fumbling to prepare their first feasts.

For example, the Census Bureau on Nov. 19 reported August soybean exports of 2.273 MMT — 73 MMT a day — a good number at the end of the 2024 marketing year. But weekly numbers put out six days before and covering through Sept. 25 totaled 2.194 MMT — 78 MMT daily. So, the Census numbers were a bit anticlimactic.

Investors covering a variety of markets faced an exponentially more daunting task: Trying to figure out which of the updated datapoints mattered, and to whom. Many of their questions focused on the Federal Reserve, and what the central bank will do with interest rates at its next meeting Dec. 9-10.

Which data are accurate?

Both bookends of the Fed’s dual mandate—price stability and full employment—suffered from the time warp, including key benchmarks for inflation and jobs. Consider the report put out Nov. 20 by the Labor Department, which created guesses about guesses.

- Payrolls, the agency said, rose 119,000, more than doubling trade estimates.

- The unemployment rate, however, in the same report ticked higher to 4.4%, up from 4.1% a year earlier.

Such contradictions are not unusual, except for one not-so-minor fact: Households were surveyed before the shutdown. Businesses continued to update their positions electronically throughout the closure, which begged the question: Were historic comparisons and trends, not to mention the report itself, even valid?

As a result, some on Wall Street saw bullish tea leaves, while others viewed only bearish signs. Betting on Federal Funds Futures saw a 71% chance of a quarter-point drop from the current rate range of 3.75% to 4%, much higher than the previous week, but down from the 95% expecting a cut as recently as October. By the end of 2026, these investors believe rates will be 3% or less, as the Fed works to avoid a recession.

The gyrations rippled to many other markets. Stocks rallied and sold off hard to a six-week low only to reverse higher to end the week.

In grain trading, nearby corn tumbled to its own one-month bottom, while soybeans saw momentum drained from news about long-awaited Chinese purchases.

Markets will sort all of this out—eventually. Farmers trying to plan sales of 2025 crops and plantings for 2026 can only wonder how fresh facts are: Which can be safely shut in the freezer, and which to dump in the trash.

This doesn’t mean sitting on your hands and doing nothing. All those dishes must still be washed, dried and put away. So, prioritize. And look for opportunities in the chaos and uncertainty. Here are a few to consider:

Sell or hold?

Nearby soybeans surged to $11.695 when confirmation of Chinese business finally soothed shutdown nerves, ending the week at $11.25. With average cash beans some 75 cents less, most producers faced red ink selling from inventory, depending on local bids and how much of the full cost of production they needed to cover. That management decision varies from farm to farm.

Aid from the Trump Administration may offset some or all any losses, so growers playing defense likely are best off using “prevent” coverage, not an all-out blitz. Out-of-the-money puts or measured incremental sales could provide that protection.

Complicating matters: Questions surfaced about China’s need for additional purchases, after its stockpiles swelled on weaker demand and total imports in September and October that respectively were 15% and 7% higher than the previous two years.

Chinese customs data listed no imports from the U.S. involved with that trade, so U.S. Treasury Secretary Scott Bessent’s target remains an out-of-reach brass ring for now.

Pricing 2026 crop beans is even harder, with costs about the same, unless buyers grow nervous about prospects in South America.

Put energy into energy

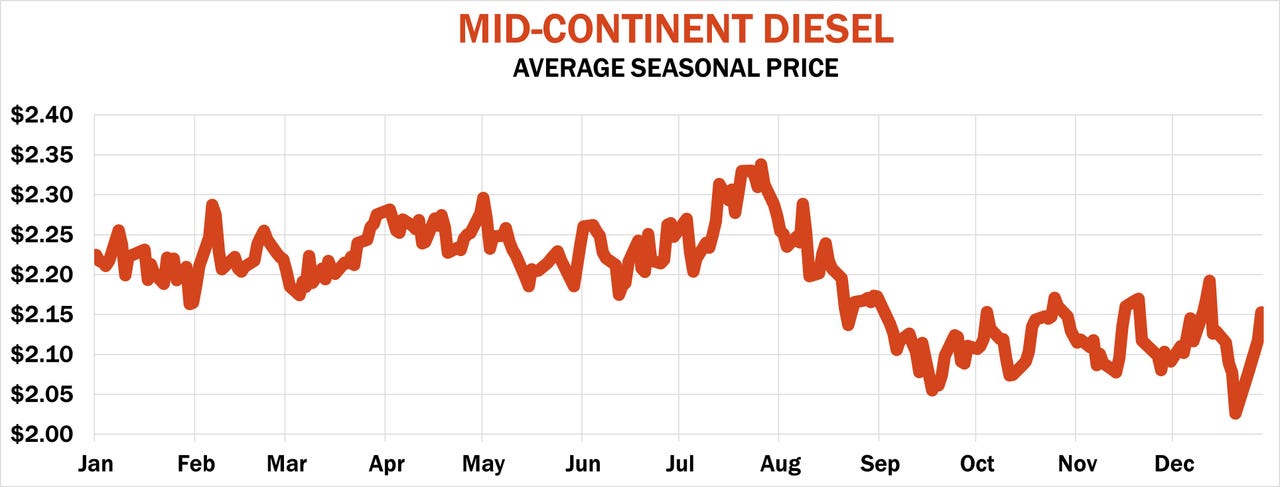

With field operations mostly finished and corn out of the dryer, farmers’ energy use is winding down for the year. While agricultural demand is reduced, look for buying opportunities for diesel, and sometimes even propane.

Seasonally, ULSD prices on average peak ahead of planting and harvest, with dips noted around Thanksgiving and Christmas. But swings can be fast and furious, too, so consult dealers for their opinions if you don’t track your own levels.

Propane stocks are plentiful headed into winter when heating demand normally lifts prices higher. That should provide buying opportunities to refill tanks. In addition to weather, a sudden surge in other energy markets, especially crude oil, could trigger cause prices to spike — think Middle East problems, or perhaps even the growing potential for a confrontation with Venezuela. Sure, you won’t need drying fuel for nearly another year, but protection now could be an ounce of prevention.

Find opportunities in chaos

Big disruptions to life’s structure may be unsettling. But they also move markets, sometimes in ways that benefit those able to capture opportunities.

Predicting these Black Swans by definition is impossible. Put systems in place, not only for following events influencing markets, but also for making fast decisions to capture the chaos. It may be the only way to turn a true profit in corn, with average cash prices some 80 cents below the average cost of production.

This means more than just watching headline news for events that move futures markets, like Russia’s invasion of Ukraine.

Basis in the cash market may be the best hope for many growers, and that aspect of prices is local. What happens if a blizzard or ice storm leaves livestock operations in your area unable to source grain to feed hungry critters? You could wind up being a hero to them and to the family members who depend on you—but only if you get on the phone instead of throwing another log on the fire.