With Harvest ‘25 in the rearview mirror and snow blanketing the entire Midwest, shouldn’t we have plenty of time to look back and reflect? I’m thinking a week by the fireplace to just bring up your yield maps, look back at those beneficial rain events and determine which hybrids will or won’t make the cut.

But we all know how quickly agriculture moves. We don’t have that kind of time. The day the combine made its last pass this fall, most of us already had shifted our focus to finishing off 2025 marketing plans, monitoring South American crop progress and prepping for Plant ‘26. It’s definitely “Full steam ahead!”

However, if you can give me just 10 minutes today, I’d like to show you how 2025 might have a story to tell about what could be in store for 2026.

Big changes can happen

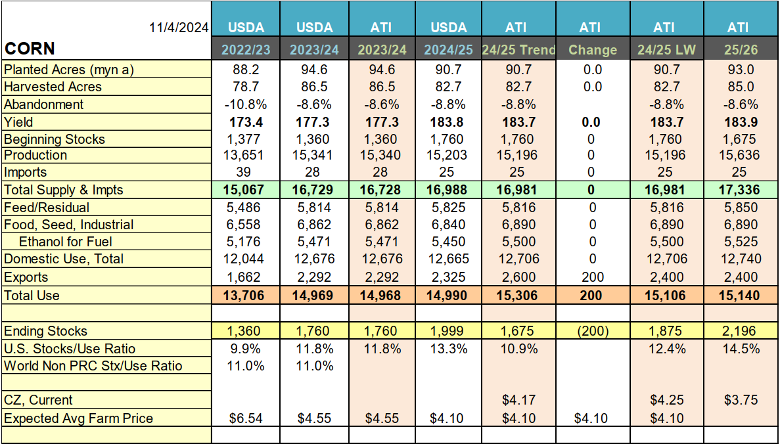

Let’s go back to early November 2024 and talk about corn for a second. The USDA in October 2024 predicted a record U.S. yield of 183.8 bushels per acre, a robust 2024-25 carryout of 2 billion bushels, and a burdensome Stocks-to-Use Ratio of 13.3%. The market was thought to be completely flush with supply.

Yet, that all changed with the next three WASDE releases in November and December 2024 and January 2025.

- The November report was simple, pulling back yield 0.7 bpa, bringing average yield to 183.1 bpa, and leaving usage alone. This dropped carryout 61 million bushels.

- In December, USDA increased usage by 200 million bushels and left production unchanged.

- Then the January report dropped both yield and usage, reducing yield 3.8 bushels per acre to 179.3 bpa, and increasing exports/feed usage by a combined 75 million bushels. This took the early November carryout from 2 billion bushels down to 1.54 billion bushels. Suddenly 460 million bushels, or nearly one-third of our entire U.S. carryout, was wiped from the slate in just 60 days!

Obviously, prices rallied dramatically following those changes. March corn futures, for example, were trading around $4.25 after the November WASDE, and by mid-February topped out at $5.04½. Farmers were heavy sellers during this time as they cleaned out on-farm inventories and got a good start on new crop marketing as well. We couldn’t market it all at $5, but sales at $4.50 and $4.70 became possible, and really helped add to the bottom line.

Look at 2024-25 USDA numbers

So, could this be happening all over again? I honestly think it is possible.

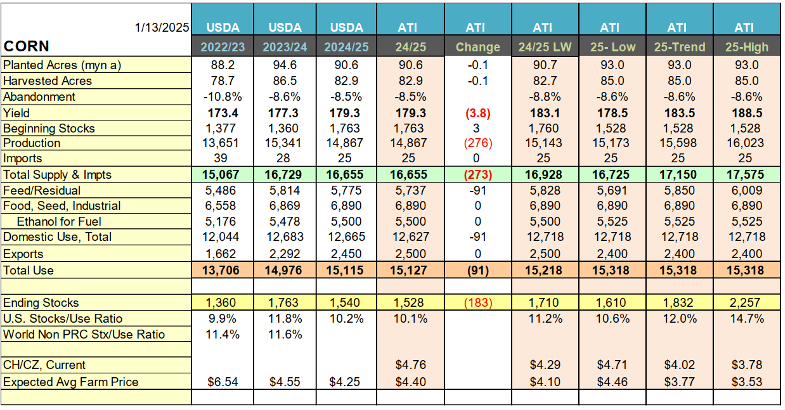

You must go back to this summer when USDA’s August estimate pegged U.S. yield at a whopping 188.8 bpa (9.5 bpa higher than the all-time record) and increased ending stocks 457 million bushels. We went from being relatively snug at 1.67 billion bushels to zero worries at 2.12 billion. And our carryout has remained above 2 billion ever since.

Was that massive increase warranted so early in the growing season? We know much of that estimate was made with aerial imagery that dramatically changed with the dry finish we had. Is it not possible to think that we could see a relatively large drop in yield in January? We just saw USDA adjust yield 0.7 bpa lower in November 25 just like they did in November ‘24. In the December ‘25 report, USDA increased corn exports 125 million bushels to a whopping 3.2 billion bushels. That’s nearly two times the U.S. export pace from just three years ago. Wow!

I’m not going to bet my entire 2025 marketing plan on the idea that USDA in January 2026 will do exactly what they did at the start of this year. I’ve been doing this far too long to think I can out-guess USDA or that I can predict price movement. But I am going to do some things to take advantage of the market in case history does in fact repeat itself.

- Stay vigilant with your marketing this winter.

- Revisit your break-even prices from 2025 and your estimates for 2026.

- If/when you get the chance to lock in at your break-even levels or higher, force yourself to sell large percentages.

- Use options to defend those decisions.

Don’t sweat the doom and gloom in agriculture right now. I think better times are coming.

Advance Trading, ATI, and ATI ProMedia are DBAs of CIH Trading, LLC, a CFTC registered Introducing Broker and NFA Member. The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading. Past performance is not necessarily indicative of future results.