Calendar year 2025 delivered its share of surprises in the commodity markets. One of the most notable was the prolonged trade dispute between the U.S. and China, which persisted through most of the year. This conflict contributed to a sharp downturn in soybean futures, pushing prices below $9.70—a stark reminder of a key marketing principle: Success isn’t about predicting prices. It’s about protecting against unexpected market shocks. With that in mind, a disciplined risk management plan will be essential for effective marketing in 2026.

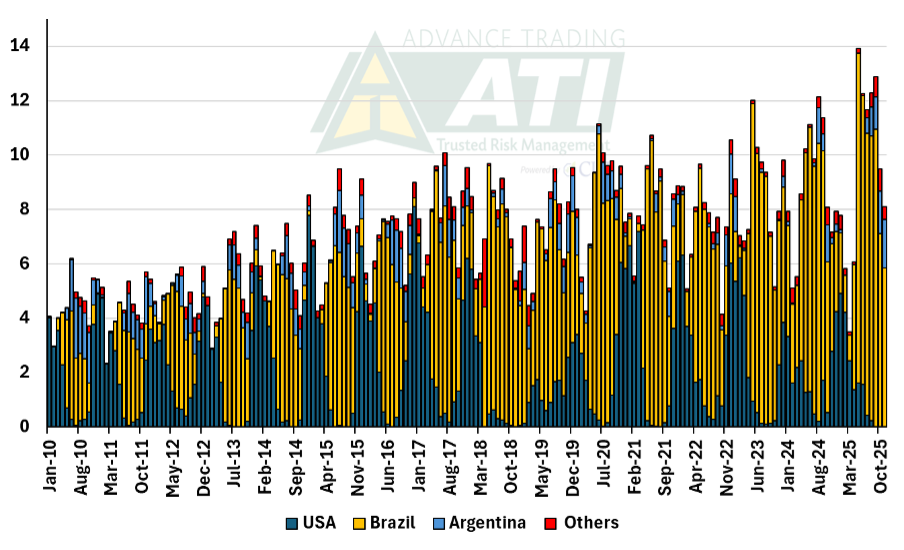

China shops with South America

Few would argue that 2025 was full of market surprises. A prime example is the steep decline in Chinese soybean imports from the U.S., which caught many traders off guard. For three consecutive years, China was a dominant buyer of U.S. soybeans. Optimism grew early in the year that a new administration might avoid a major trade dispute. Instead, China shifted nearly all purchases to South America once those supplies became available in the spring.

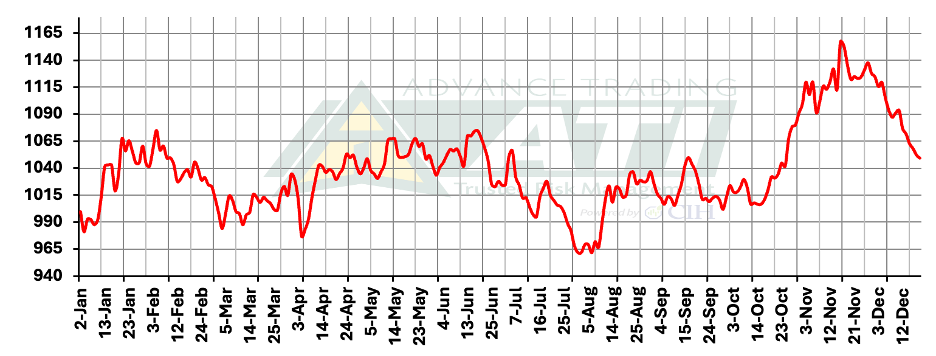

This shift was a key driver behind soybean futures falling below $9.70 during the summer (Figure 2 below). Prices remained under pressure until a trade agreement was reached in the fall.

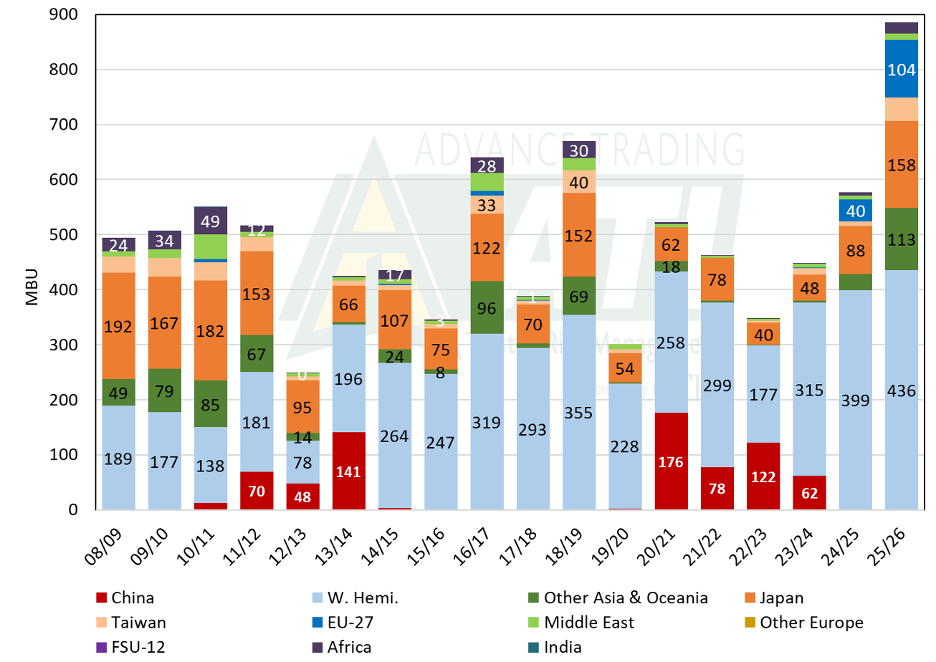

Under the new deal, China committed to purchase 12 MMT of U.S. soybeans in 2025, followed by 25 MMT annually from 2026 through 2028. However, with USDA export sales reports delayed by the government shutdown, official data only began trickling out on Nov. 14. Since then, traders have closely monitored flash sales announcements, hoping to confirm progress toward the 12 MMT target—now extended to February 2026. As of Dec. 11, official commitments stand at 5.41 MMT, but trade sources estimate China has already bought more than 8 MMT, approaching 70% of the agreed volume for 2025.

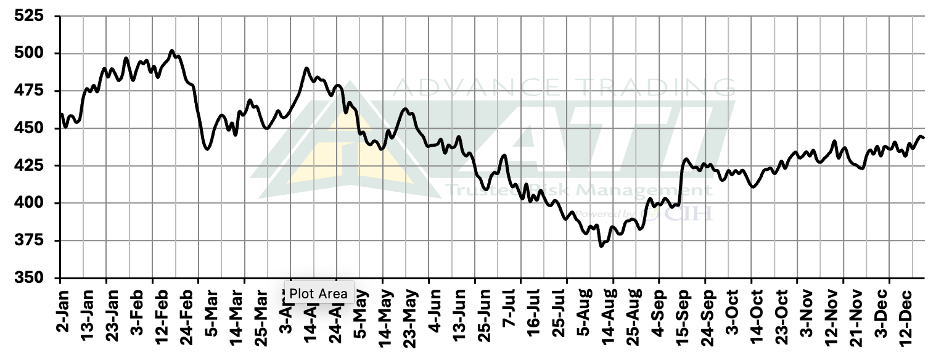

Corn export demand strengthened

Another unexpected development was the strength of U.S. corn export demand. When forecasts pointed to a record U.S. corn crop, many feared prices would collapse well below $4. While futures briefly dipped under that level in late summer, they rebounded and gradually strengthened during and after harvest, driven largely by record U.S. corn export sales to traditional and non-traditional destinations.

Key takeaway: Don’t wait on perfect

What do these surprises teach us?

- First, markets are inherently unpredictable. Even seasoned analysts cannot foresee every twist and turn. The trade war and its ripple effects on soybean prices illustrate how quickly fundamentals can shift.

- Similarly, the resilience of corn prices despite record production shows that demand shocks can offset supply concerns. These dynamics underscore why risk management is not optional—it’s essential.

A common mistake among producers and marketers is waiting for the “perfect” price. But the reality is that no one knows when the high will occur—or if it already has. Instead of chasing an elusive peak, focus on capturing profitable opportunities and protecting against downside risk. That’s where tools like futures and options come into play. They allow you to lock in favorable prices or establish a safety net, regardless of market direction.